Here's the thing: investing in precious metals like silver has long been a hedge against economic uncertainty. Especially during turbulent times—think inflation surges or global crises—entrepreneurs and everyday investors alike turn to silver not just as a commodity, but as a store of value. Sounds crazy, right? Yet, amid the chaos, savvy buyers continue stacking silver and building resilient portfolios.

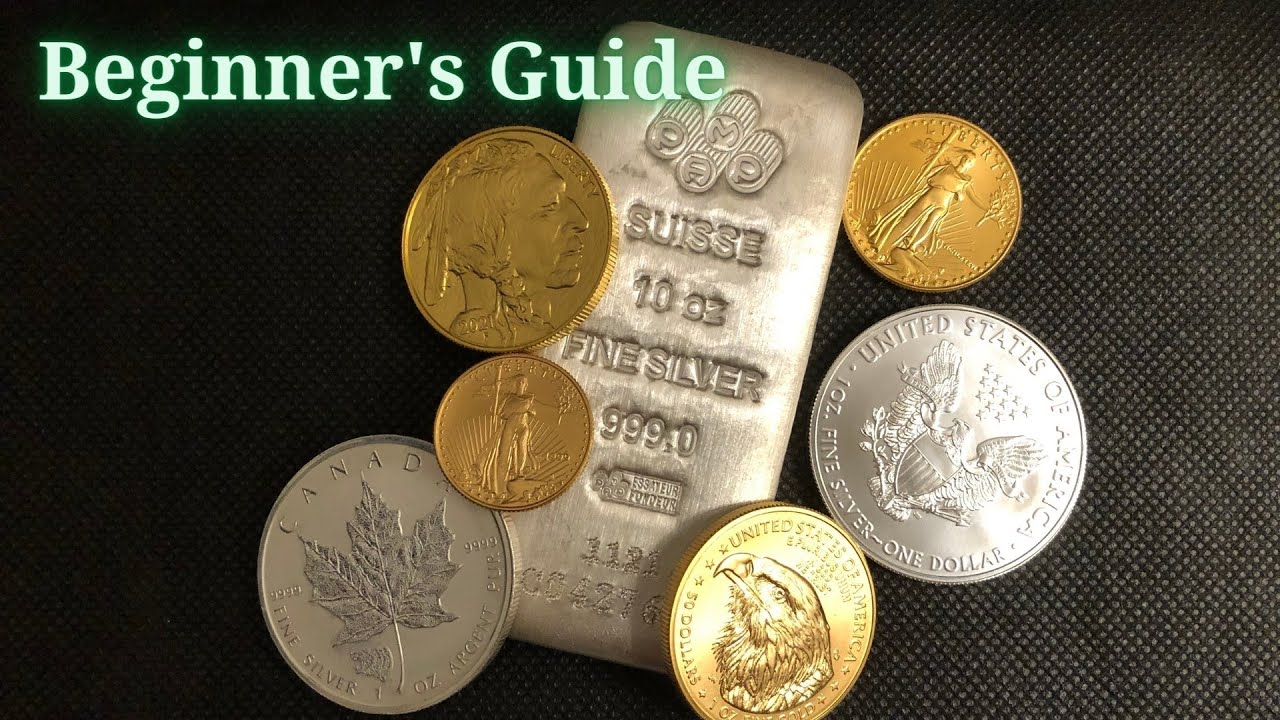

But if you’re just starting to explore silver bars as an investment, you might be intimidated. Maybe you’ve heard conflicting advice or worried about scams. Ever wonder why so many newcomers freeze up rather than dive in? It often comes down to trust and a lack of clarity about what actually makes a “good” silver bar. This post cuts through the noise: we’ll cover the essentials from which bars to buy, to the trusted names in the business—like Gold Silver Mart—and we’ll even tackle the classic debate— 10 oz vs 100 oz silver bars. Let’s get you confidently stacking your silver with clear, actionable insights.

Entrepreneurship During a Crisis: Why Silver Stays Relevant

Crises breed innovation. Entrepreneurs who rise to the occasion in tough times often identify real needs. The precious metals market, especially silver, has been a fertile ground during downturns. Whether it’s startups offering secure shipping or dealers providing transparent pricing structures, entrepreneurs help make silver investment more accessible and trustworthy.

Gold Silver Mart is one such company that’s earned a reputation for combining reliability with user-friendly service. Their approach—clear pricing, certified authentic bars, and responsive customer support—addresses the core anxiety many investors have: “Is this a safe, worthwhile purchase?”

So, what does that actually mean for you? It means you're not alone in navigating this market. You have allies like Gold Silver Mart who prioritize trust, reducing the intimidation factor for newcomers.

Gold and Silver as an Inflation Hedge: The Why Behind the Hype

Everyone talks about gold and silver being inflation hedges. But why? It’s rooted in the intrinsic value these metals hold, unlike fiat currency, which can be inflated away by central banks printing more money. When inflation spikes, the purchasing power of paper dollars declines—but silver’s value often rises or at least maintains purchasing power.

Here’s the crux: silver isn’t just precious metals for show—it has industrial uses that anchor its demand. So, during inflationary periods, silver benefits from both monetary and practical value. This dual role makes it a particularly appealing metal to stack.

Why Choose Silver Over Gold?

- Affordability: Silver bars are significantly cheaper per ounce than gold, allowing investors to buy more physical metal for less capital. Flexibility: Silver’s lower price point means you can build your position gradually. Whether opting for 10 oz bars or stacking towards a 100 oz bar, there’s flexibility. Demand Growth: Industrial demand adds a layer of price support silver doesn’t always get from gold.

Stacking Silver: 10 oz vs 100 oz Bars

One of the first decisions investors face is whether to start stacking smaller bars like 10 oz or go straight for the bulkier 100 oz bars. Both options come with pros and cons, so let’s break them down.

Criteria 10 oz Silver Bars 100 oz Silver Bars Initial Cost Lower, affordable entry point High upfront expense Liquidity Easier to sell smaller quantities Harder to liquidate partial amounts Storage & Handling Compact, easy to store Bulkier, needs secure storage Premium Over Spot Higher premium per ounce Lower premium per ounce (more cost-effective) Use Case Beginner-friendly, building a stack Experienced investors optimizing costsIn essence, 10 oz bars are ideal for those new to the market or who want to build a position over time without a big upfront commitment. The tradeoff is paying a higher premium per ounce. On the other hand, 100 oz bars bring cost efficiency but require you to commit significant capital and consider secure storage upfront.

Reputable Mints and Low Premium Bars: Trust Means Everything

When it comes to silver bars, the mint’s reputation can’t be overstated. Why? Because when you buy physical silver, you’re also buying peace of mind. Bars from reputable mints are more liquid, recognized worldwide, and theyeshivaworld.com easier to verify.

Some of the top recognized mints include:

- Johnson Matthey (JM) American Eagle (usmint.gov) PAMP Suisse Perth Mint Credit Suisse

The key is finding bars with low premiums—meaning the price you pay above the spot price of silver is minimal. High premiums can significantly erode your investment gains over time. This is where companies like Gold Silver Mart excel. They are transparent about premiums and work with reputable mints to keep costs reasonable.

Addressing the Common Mistake: Don’t Be Intimidated

Here’s a common roadblock: many potential investors get cold feet simply because precious metals feel complicated or inaccessible. Too often people tell me, "I’d like to invest in silver, but I don’t know where to start and I’m afraid of making a costly mistake."

Let me be clear: you don’t need to be a millionaire or an expert to start stacking silver. Companies like Gold Silver Mart have made it easier to buy, understand, and securely receive silver bars. No endless jargon, no cryptic pricing—just straightforward options from trusted mints.

Start small, educate yourself, and build gradually. Even a modest 10 oz bar in your portfolio represents a solid step towards diversifying against currency risk and inflation.

The Logistics of Silver: Beyond Just the Purchase

Sounds mundane, but one of my weird fascinations is the logistics behind shipping and storing silver. Fact is, handling physical silver comes with considerations beyond just buying it:

- Secure Shipping: Reliable dealers use insured, discreet shipping methods. Avoid anyone who’s vague about how they deliver your purchase. Storage Options: Home safes, bank deposit boxes, or third-party vaults each have pros and cons tied to accessibility, security, and cost. Verification: Upon delivery, verify bar markings, certifications, and weight to ensure authenticity.

Choosing reputable providers matters hugely here. Gold Silver Mart, for example, offers verified delivery tracking and works only with insurance-backed logistics partners.

Final Thoughts: Stack Smarter, Not Harder

If you’re reading this and wondering how to get started with silver bars—cut through the hype and the fear. Focus on:

Buying from a trusted dealer like Gold Silver Mart. Understanding the cost-benefit of 10 oz versus 100 oz bars for your situation. Prioritizing bars minted by reputable mints with low premiums. Learning about secure shipping and storage—don’t overlook the logistics. Starting small and building your stack over time.Precious metals investment is as much about mindset as it is about markets. It’s about anchoring your portfolio with something tangible. In a world increasingly dominated by digital assets and paper promises, that silver bar on your shelf—whether it’s 10 oz or 100 oz—represents real, lasting value.

So stop feeling intimidated. Start stacking silver now.

```